"Sometimes the best ideas come from solving your own problem."

💡The Moment Everything Shifted

It started with a quiet Saturday night — July 26, 2025. I was reviewing my credit profile, checking my debt-to-income ratio, and trying to figure out how to improve my financial health. I wasn't drowning in debt, and my credit score was decent — but I knew that waiting until things got bad would be too late.

So I asked myself:

"Why not take control now?"

But as I started my search for tools that could help me get ahead of my debt and improve my credit, I realized something frustrating:

- •I could monitor my credit score in one app

- •Track spending in another

- •Get debt payoff calculators on random websites

- •And still have to create my own spreadsheets to make sense of it all

Why were all the best tools so fragmented?

That's when the idea for DebtAva was born.

🛠️Building the App I Needed — With AI

I didn't plan to build a startup that night. But once the idea hit me, I couldn't shake it. I wanted something that could:

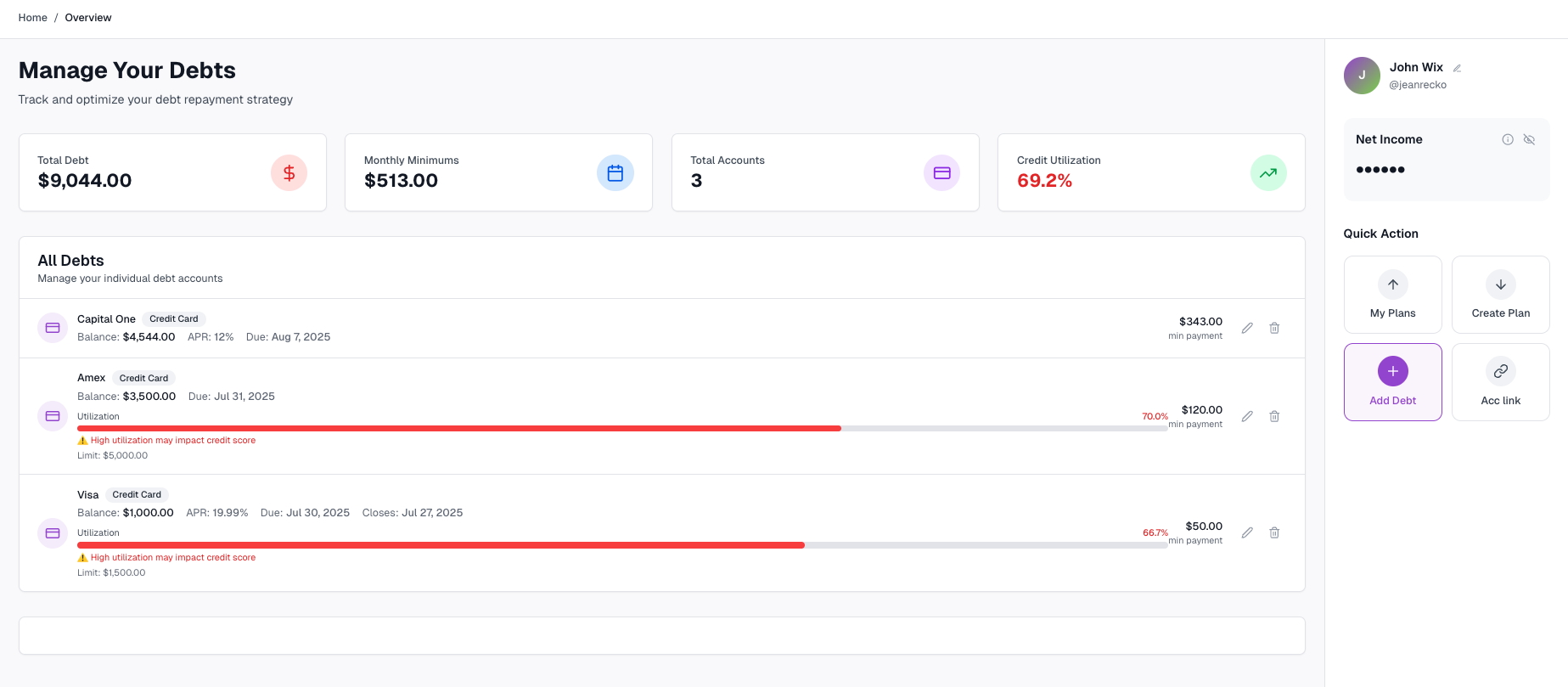

- ✅Track debt balances, interest, and utilization

- ✅Prioritize which debts to pay off first (hello, Debt Avalanche)

- ✅Show how each move impacts your credit health

- ✅Give me a simple, actionable roadmap to becoming debt-free

Instead of waiting around for someone else to build it, I opened Cursor (an AI coding assistant), and got to work.

In just 50 hours, I had a working MVP.

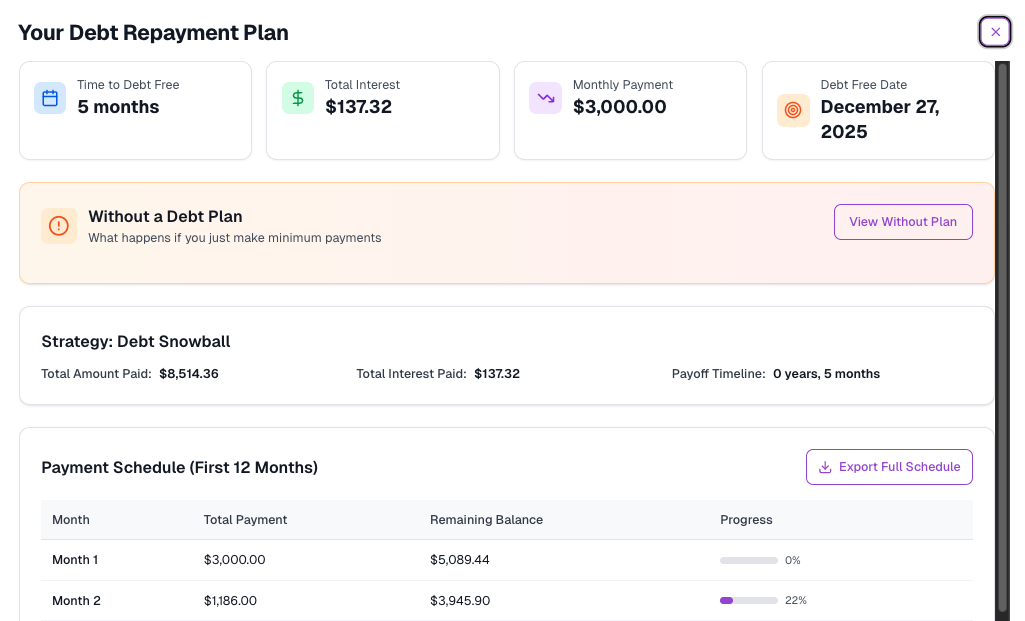

Comprehensive debt tracking - Every detail matters

It wasn't perfect.

But it worked — and I realized:

"If I needed this, others probably do too."

👋Meet Ava — Your AI-Powered Debt-Fighting Guide

What started as a financial tool quickly became something more.

I didn't just want another tracker. I wanted a coach, a partner, a guide that could help me slay the stress monsters (or "debt zombies") hiding in my finances.

So I created Ava — the AI inside DebtAva.

She helps you:

- •Analyze your debt situation

- •Prioritize which debts to pay first

- •Understand how your actions affect your credit score

- •Keep you focused, accountable, and even a little motivated

Think of her as your debt-slaying sidekick.

Real-time credit utilization tracking - Ava helps you optimize your credit health

🎯Why I'm Sharing This

This isn't a polished startup story.

This is real.

- •A real need

- •A real Saturday night

- •A real solution built by one person, powered by AI

And it's now live.

DebtAva isn't fully done yet — but it's functional, usable, and already helping people take control of their finances.

I'm building this in public.

You can follow the journey on my YouTube channel where I share behind-the-scenes videos of the build, the challenges, and how AI helped me turn a concept into a product in just days.

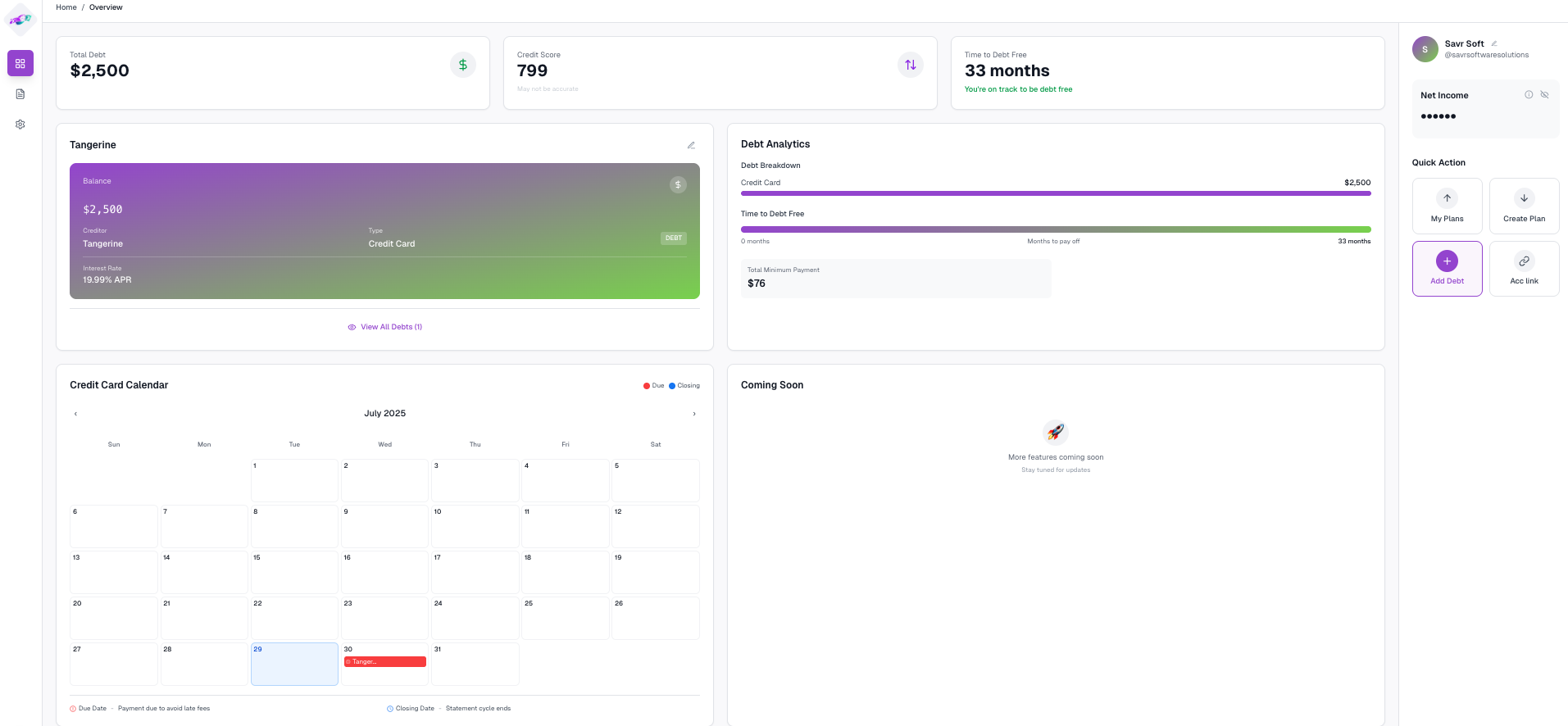

📸The Dashboard That Started It All

Here's what DebtAva looks like in action. A clean, intuitive interface that brings all your financial data together in one place:

DebtAva's main dashboard - Your financial command center

🧭What's Next for DebtAva?

I'm just getting started.

- ✅MVP is live

- 🔜Refining the UX and tools

- 🔜Adding full credit reporting integration

- 🔜Launching more AI-powered insights

- 🔜Bringing in beta users who want to eliminate debt faster

This isn't just an app — it's a movement for people who want to stop guessing and start progressing.

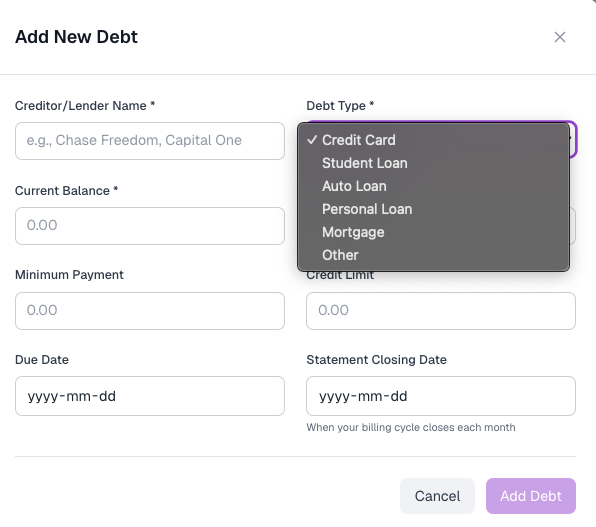

🙌Try DebtAva. Join the Mission.

If you've ever juggled multiple loans, worried about your credit score, or wished someone could just tell you what to pay first — DebtAva is for you.

Try the app.

Meet Ava.

Let's start crushing your debt together — one smart move at a time.

Getting started is simple - Add your debts and let Ava guide you

✍️Final Words

I didn't build DebtAva to go viral.

I built it because I needed it.

And if you do too, I'd love for you to join me on the journey.

Together, let's slay some debt zombies and reclaim financial peace.

— Recko Jean

Founder of DebtAva

Builder. Dreamer. Doer.